When you first entered the workforce, you probably had a huge eye-opener when you received your first paycheck and the paycheck deductions.

It’s pretty upsetting when you’re promised to be paid a certain amount, and the tax deductions aren’t disclosed. It’s just assumed that you know about taxes and how to complete a Form W-4.

Even when teenagers enter the workforce – no one tells you these things! And some go on working for years still never understanding, only accepting it.

We’re going to change that.

EMPLOYEE TAXES

If you’re an employee, there are taxes that are withheld and remitted on your behalf by your employer. Which is why if you make $10 an hour, you only take home a portion of that.

Let’s break each tax down.

FICA (SOCIAL SECURITY & MEDICARE)

The two taxes that are required to be withheld, regardless of your tax situation, are Social Security and Medicare Tax otherwise referred to as FICA.

The Social Security tax rate is 6.2% and Medicare is 1.45% or 7.65% together.

So, out of the $10 an hour rate, you pay $0.765 to FICA.

Making your take-home hourly rate $9.24, assuming you don’t have to pay the following two taxes.

But before we move on to those two taxes, let’s discuss why you have to pay FICA. Since the purpose of this is to understand your deductions…

Social security taxes are withheld to fund retirement, disability, and survivorship benefits that Americans receive from the Social Security Administration. You can begin withdrawing Social Security benefits once you reach age 62 or older, or are disabled or blind and have enough work credits. The benefits are based on your earnings record since you started contributing. Survivorship benefits are paid to widows, widowers, and dependents of eligible deceased workers. If you want to dive deeper into social security tax, click here.

Medicare tax funds a portion of the Medicare insurance program, also known as “hospital insurance tax”. Medicare is health insurance for people age 65 or older. Younger people with disabilities can apply for Medicare as well. Medicare has different parts. Part A is inpatient or hospital coverage, Part B is outpatient or medical coverage, Part D is prescription drug coverage. If you want to learn more about Medicare, head here.

FEDERAL INCOME TAX

Federal income tax is withheld and remitted by your employer on your behalf. So, rather than you having the responsibility of paying the tax throughout the year, your employer sends it in for you.

This would be similar to you giving someone a bill (with your payment included) and having them drop your payment off at the appropriate location. They aren’t paying the bill for you, it’s your money, they are simply transporting it on your behalf to make sure the payment is received.

Federal income tax is used to fund national programs and various operating expenses for the country. Income tax is the largest source of revenue for the U.S. government.

You have an obligation to pay income tax throughout the year. However, you have NO obligation to overpay in federal income tax throughout the year. That is what the Form W-4 is for. This form is used to tell your employer (or HR personnel) how much income tax withholding you need remitted.

This tax withholding is different for everyone because it depends on your individual tax situation. Whereas with FICA, everyone has the same 7.65% withholding – otherwise referred to as a flat tax rate.

It’s important to understand how to correctly fill out your form W-4 (see instructions below) that way you are not overpaying in taxes throughout the year. One easy way to tell if you are overpaying in taxes is if you receive a big refund each year that you file your income tax return.

STATE INCOME TAX

State income tax is similar to federal income tax. It all depends on your tax situation and if your state even collects income tax.

Eight states do not have an income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire taxes only interest and dividend income, not earned income.

Again, it’s important to fill out the state W-4 correctly to ensure that you are not overpaying throughout the year. It’s your money, so don’t treat the IRS and state department of revenue as your savings account.

Let’s continue with our example. You have both federal and state withholding, for example, 10% for federal and 5% for state. Now your $10 an hour rate is deducted by $1 for federal and $0.50 for state. Making your net hourly rate, $7.74… not as appealing as a $10 an hour rate.

How about we go a step further and say that your correct withholding should be 5% for federal and 2% for state. This would increase your net hourly rate to $8.54. Nearly a dollar difference!

Now, do you see why it’s important to make sure your form W-4 is correct?! If you continued with incorrect withholding, you would be missing out on an extra dollar an hour. Then you’d have to wait until you file your tax return to get that money back. Wouldn’t it be better to get your money when you earn it?

Before you say, “well, I’ll just get a nice big refund in April”, take the time to read why a big refund is poor tax planning.

EMPLOYER TAXES

Your employer has tax obligations for you as well. These employer taxes are paid out of the company’s pocket, which means, the taxes do not reduce your wages.

FICA (SOCIAL SECURITY & MEDICARE)

Your employer must match FICA taxes at the same 7.65% rate. Therefore, you are paying 7.65% and your employer pays 7.65%, making your total FICA contribution 15.3%.

UNEMPLOYMENT (FUTA/SUTA)

Employer’s also fund unemployment insurance. These employer taxes fund the unemployment system, which is designed to pay benefits to workers when they lose their jobs through no fault of their own.

For federal unemployment tax or FUTA, your employer pays 6.0% on the first $7,000 in wages paid to you each year. After you’ve been paid $7,000 for the year, your employer no longer pays FUTA on you for the remainder of the year.

If your state is subject to unemployment tax (SUTA), the same concept will apply. However, the wage base and rate may be different. Also, if you have wages subject to state unemployment tax, your employer may receive a FUTA credit of 5.4%. This would reduce the FUTA rate to 0.6%. Yeah, I know… they can’t just make taxes easy.

Here’s how it works: January through March you received $6,000 in gross wages. Your employer pays $360 to FUTA for the quarter. April through June, you received another $6,000 in gross wages. Your employer only pays $60 for the second quarter ($1,000 taxable wages X 6.0%) Only $1,000 is taxable for second quarter ($6,000 first quarter + $1,000 second quarter = $7,000 taxable wages).

Here’s a quick summary of payroll taxes and who pays what:

| PAYROLL TAXES | ||

| TAXES | EMPLOYEE | EMPLOYER |

| SOCIAL SECURITY | ● | ● |

| MEDICARE | ● | ● |

| FEDERAL/STATE | ● | x |

| FUTA/SUTA | x | ● |

COMPLETING FORM W-4

The IRS has an income tax withholding estimator on its website. It’s pretty handy and generates the form W-4 for you.

You will want your most recent pay stub for yourself and your spouse, if applicable. If you have other variables on your return, like a business, stocks, etc. then also have your most recent statements on hand.

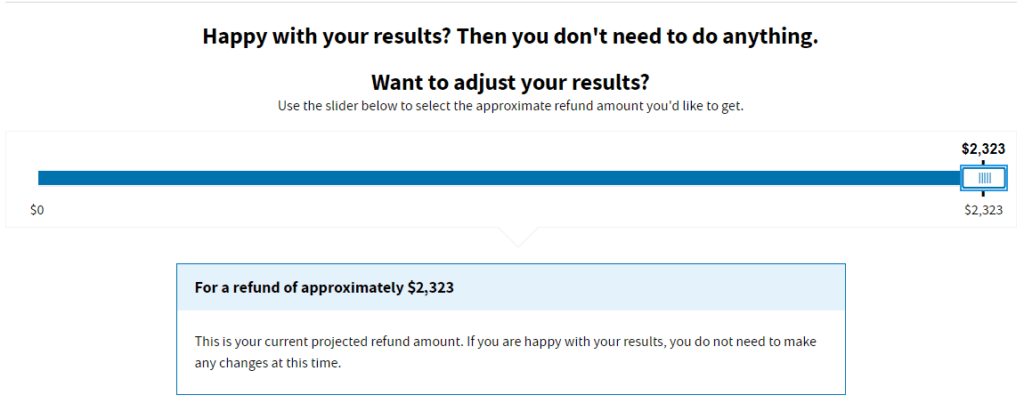

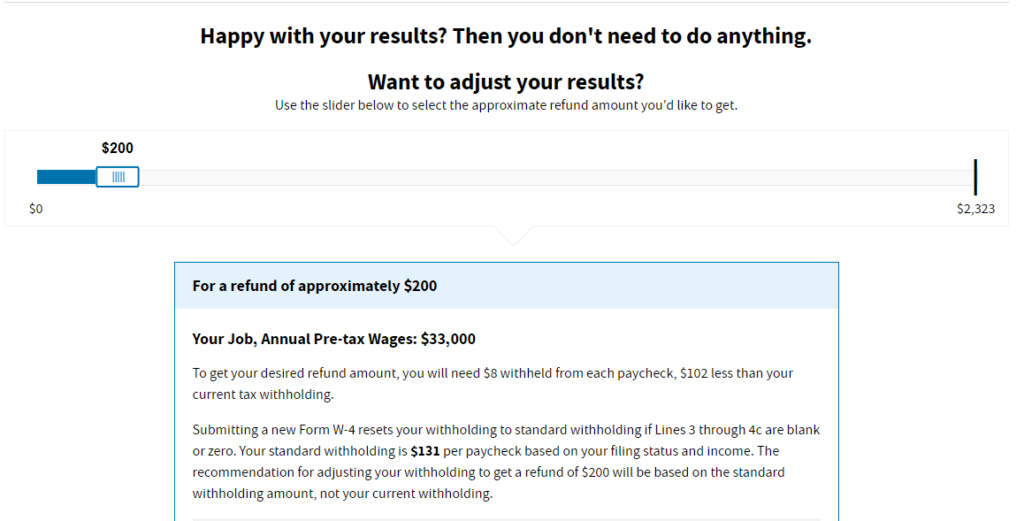

Then go through all the questions. Once you get to the end, there will be a sliding bar for you to determine how much of a refund you would like to receive.

Once you select your amount. If you’re wanting to avoid overpaying in taxes then put either zero or $100-200 refund for a little cushion.

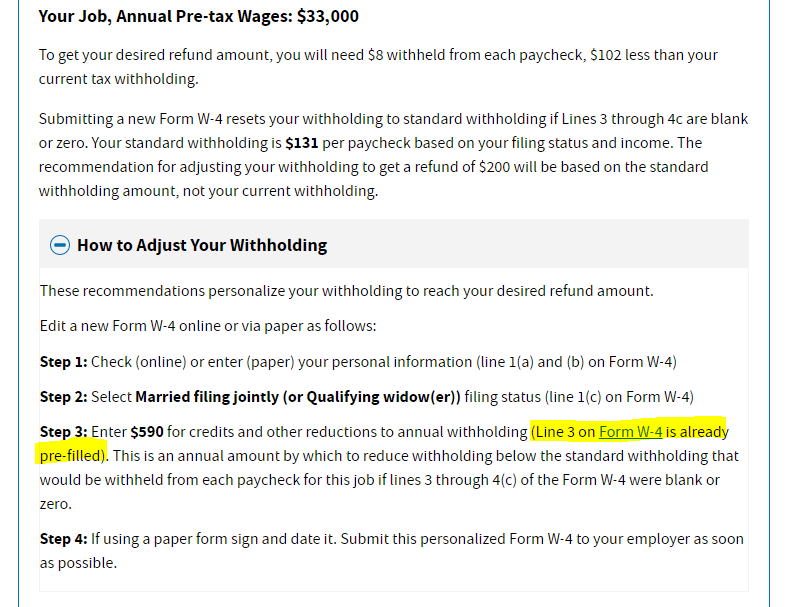

Then you will want to click the Form W-4 link within the “How to Adjust Your Withholding” section.

Finish filling out your personal information on the form, then print and sign Form W-4. Once you’re done, turn the form over to your employer or HR person for them to update your withholding.

It’s as easy as that!

**Please be aware that if you adjust your withholding anytime throughout the year, then you will need to readjust your withholding at the beginning of the next year to determine the appropriate full-year amount. This tool is designed to correct your withholding for the remainder of the year.

Hopefully, this helps you understand your paycheck deductions, and why it’s important to understand your deductions. Follow along for more tax tips!

All videos are made with Animaker, sign up for free today!