Accounting methods are important to understand especially if you own a business. Business owners use either cash or accrual accounting methods, whether they know it or not.

CASH VS. ACCRUAL

Let’s quickly do a refresher on the difference between the two…

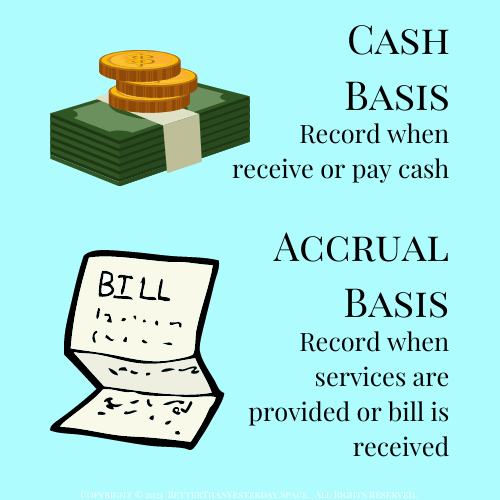

CASH BASIS

Cash basis means you record the transaction when it hits your bank account. When “cash” exchanges hands (or your bank accounts).

So, for example, you receive a utility bill on August 15th, but it is not due until September 5th.

You record the transaction when the cash leaves your bank account which is September 5th in this case.

ACCRUAL BASIS

Accrual Basis means you record the transaction when it occurs.

So, in the same example, you receive a utility bill on August 15th, but it is not due until September 5th.

Even though the cash will not leave your bank account until September 5th. You record the transaction on the day you received the bill August 15th.

It is important to understand the difference between cash and accrual basis because if you are looking at a cash basis financial statement, it is telling you something different than an accrual basis statement.

WHEN TO SWITCH

Most start-ups and small businesses use the cash basis accounting method. Cash basis is simple to understand and easy to implement. However, there are IRS regulations on reporting with the cash basis method.

You can always report on an accrual basis, but on a cash basis method, once you reach a certain level in your business you need to make the switch.

To make this short and sweet, the IRS has a gross receipts test and any corporation or partnership (that is not a tax shelter) can generally use the cash basis method IF its average annual gross receipts for the last three tax years were $26 million or less. If you’d like to read more in-depth about the IRS regulations on the cash basis tax reporting method, click here!

PROS & CONS

CASH BASIS

PROS:

- It’s simple and reflects how much money you have available

- You are only taxed on the money you receive vs. all the invoices issued

CONS:

- Less accurate – you can manipulate your profitability by waiting to pay bills

- Doesn’t help make management decisions since you only have an after-the-fact view of the financial statements

ACCRUAL BASIS

PROS:

- More accurate picture of the business finances and performance

- Management decisions can be made with more confidence due to greater accuracy in the financial statements

CONS:

- It’s more complex since you have to record invoices rather than just looking at your bank account

- You have to pay tax on income before you actually receive the payment.

- If the customer never pays you – you can claim the tax back on your next return

You need to select the appropriate accounting method that clearly reflects your income and expenses. There is also inventory to consider in this decision. If you have inventory and need to report inventory on your tax return, then take a look at the IRS Publication 538 “Inventories” section. Reach out to your tax professional to help select the appropriate accounting method for your business!

Follow along for more financial tips!

All videos are made with Animaker, sign up for free today!