Bookkeeping can be really overwhelming to many small business owners and personally.

This is why a majority of people don’t have bookkeeping in place for themselves or their small businesses.

Let’s put an end to that!

We’re going to only focus on the BASICS of bookkeeping, to keep it SIMPLE!

And for all of you accountants reading this –

When I say basics, I mean only income and expense tracking.

We will save Assets = Liabilities + Equity for another bookkeeping lesson.

Download the bookkeeping template to follow along.

What is Bookkeeping?

Of course, bookkeeping is more than just income and expenses.

However, I think income and expense tracking is easier to digest for those that get overwhelmed when the word bookkeeping is spoken.

Basically, bookkeeping is recording your financial transactions so that you can see what your total numbers look like on a monthly, quarterly, or annual basis.

For instance, wouldn’t it be nice to know how much you spend on fuel or groceries every month or every year? Knowing your numbers is crucial for small business owners, and it’s very beneficial for yourself personally too.

Having the records to show what your numbers are will help you make decisions and build a budget.

Bookkeeping is pretty much a fancier word for being organized.

Income

Income is really easy to categorize because a majority of the time you only have a few categories that you need to track.

When setting up your income categories, think about what would benefit you the most. What information do you care to know? Or what information would just be cool to know?

Let’s look at a small construction business first.

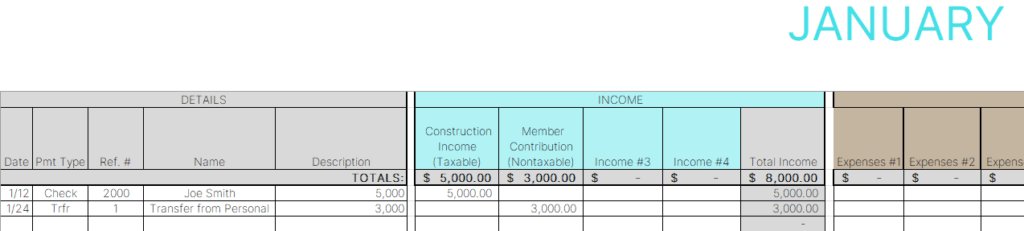

Option number one

For income tracking, there could be just “Construction Income”. That’s it.

Potentially, if you contribute personal money to your business then you’d want a “Member Contribution” category. Since this is nontaxable money.

Or you can list those two income categories as “Taxable” and “Nontaxable”.

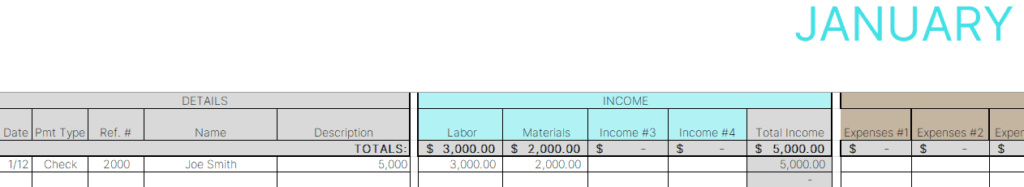

Option number two

You could separate your income by Labor and Materials categories.

This one may be a pain if you bill everything together since you’d have to split your invoice. So, unless you really want to know these two numbers, I’d maybe steer clear of this option.

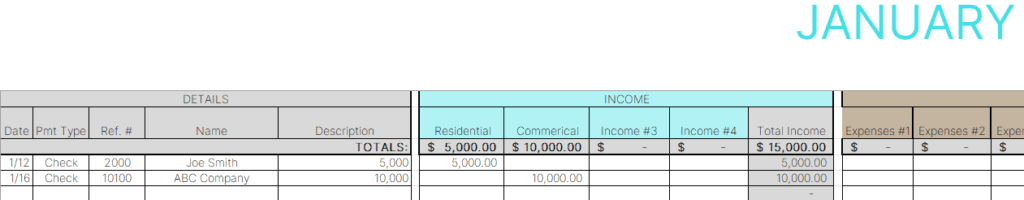

Option number three

You could separate your residential and commercial income or new construction and remodel construction.

This would be easier to track since your bills will be invoiced to either a residential project or commercial project, etc.

**If you use the Better Than Yesterday Bookkeeping Template then you ONLY need to change the income and expense categories in January. The categories will change for all the other months and on the Profit & Loss tab.**

It’s really up to you how you’d like to track your income. These options are just to get your mind thinking of the possible ways for you to separate income.

Decision-Making

In the construction example if the business owner used the third option –

Then they would be able to make decisions, like…

say they are considering switching to just commercial projects since they enjoy those worksites more.

Well, recording their income this way gives them the ability to evaluate the income from commercial projects and see if commercial income will be enough to cover their expenses, and earn them a profit.

Okay, now let’s look at your personal income options.

We will use a married couple with three jobs between the two. Spouse #1 has one job, and Spouse #2 has two jobs.

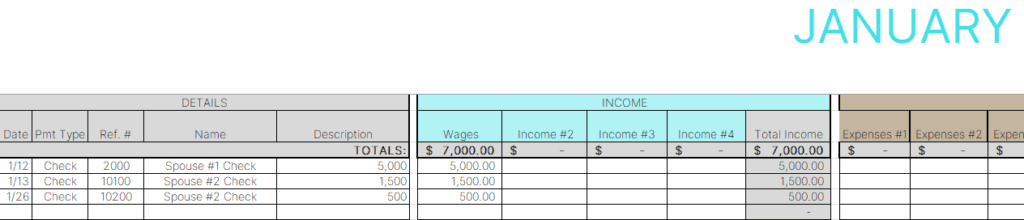

Option number one

This could be again, just “income”. The combined income between all three jobs, not separating just simply income.

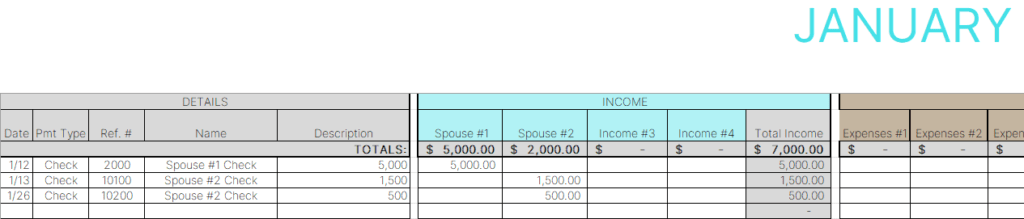

Option number two

You could separate the income categories between Spouse #1 income and Spouse #2 income.

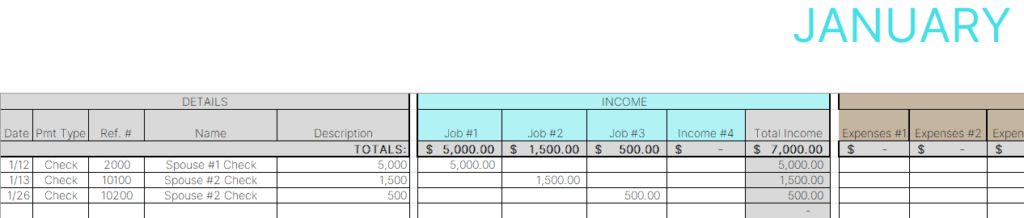

Option number three

You could separate the categories between jobs. Job #1, Job #2, and Job #3.

Again, this is to benefit you and help you make future decisions. So, choose which income tracking works best for you!

Decision-Making

This couple uses option number two and is getting ready to have a baby.

They are looking at their income from Spouse #2 (the one getting ready to have the baby) and they would like to save up enough money to cover Spouse #2’s income while they are on maternity leave.

Spouse #2’s monthly income averages $2,000 a month, and they can easily figure that they need to save $6,000 for maternity leave.

Now, let’s look at option number three where they separate income from each job.

Spouse #2 would like to give up one of their jobs.

Having their income split this way will give the couple the ability to review what their numbers are, and see what it would look like if Spouse #2 gives up their second job.

Knowing your numbers will help you accurately make decisions. The hard work of recording is already done and all you have to do is pull up the report.

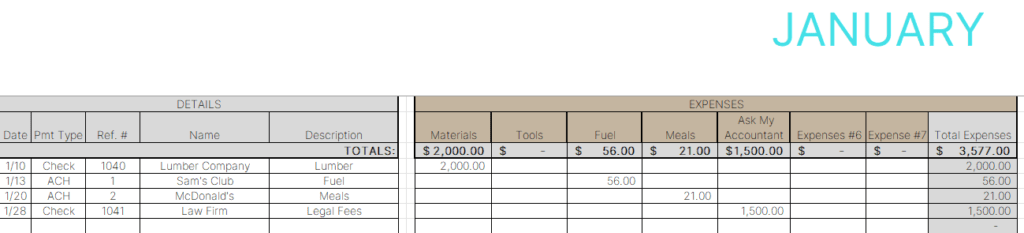

Expenses

Expense categories will be very similar to the income categories. Except there’s usually more of them.

You just need to decide what you want to know! That’s really the hardest part.

Our construction owner should have the typical expenses, like materials, tools, fuel, meals, etc.

Most of the time the owner should know where the transactions need to be categorized.

But the owner had to hire a lawyer to settle a lawsuit against their construction company. And the owner has no idea where to categorize that expense.

I would suggest having a catch-all expense category titled “Ask My Accountant” that way you can still track these expenses, and your tax accountant can easily expense these transactions that you’re unsure of.

This category helps to not hold up your bookkeeping process

Now on the personal side of things, the “Ask My Accountant” category really doesn’t apply since you are not using personal expenses on your tax return.

But that also gives you more freedom to make whatever expense categories best suit you!

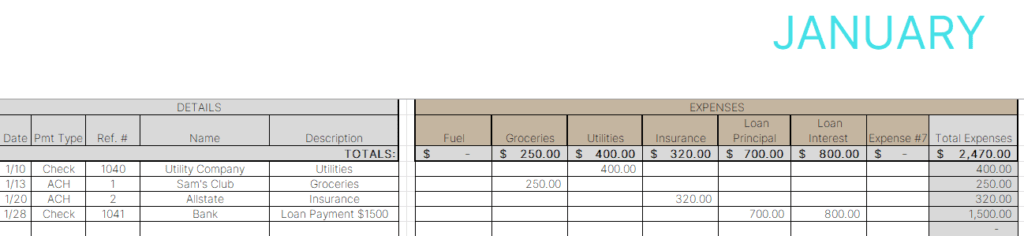

Typical personal expenses are fuel, groceries, utilities, insurance, mortgage, loan payments, etc.

If you’re a nerd, like me, then you can split your loan payments between principal and interest.

That’ll really help you get fired up about paying off your debt if you see how much of your loan payment really goes to your principal balance!

Having your expense categories will help you when building a monthly budget.

You can also make decisions easily when shopping for a new insurance company, or when you are considering refinancing your loan.

Knowing your numbers helps you make the best decisions to save yourself money!

This is a small, but HUGE step towards building your books. You do not have to perfect it the first time. Just start!

And you will get better and better as you continue to organize your income and expenses. And maybe once you’re ready you can level up to Intermediate Bookkeeping.

But for now,

Just focus on making your bookkeeping better than it was yesterday!

Follow along for more financial tips!