Wow! Look at you go! You made it to advanced bookkeeping. You are NO longer an intermediate or a beginner.

Okay, you must be a nerd… In a good way! ?

We are going to go over the simplicity of advanced bookkeeping, just like we have been for the other two sections.

BOOKKEEPING SOFTWARE

As stated in intermediate bookkeeping, you will need accounting software to make this easier on you. Yes, I know there’s a price to pay, but it’s totally worth it.

You do not want to be doing an advanced set of books in excel. So back away from the bookkeeping template if you’re serious about advancing your bookkeeping skills!

Here are a couple of software options –

- QuickBooks Online is a great option if you work from multiple devices, and for you to easily share your books with your accountant. If you choose to use QuickBooks Online, do not start with QuickBooks Self-Employed ($7.50/mo), simply because you will quickly find out that you will need to transition to Simple Start ($12.50/mo or higher).

The transition process can be a pain. So, I highly recommend starting fresh with Simple Start which is $12.50/mo or $150 annually. I don’t get any commission for recommending QuickBooks Online, I just have had to help several clients switch from QB Self-Employed to QB Simple Start and they ALL wish they would’ve started with the QB Simple Start. So, save yourself the headache and spend the extra $5/mo.

If you aren’t convinced to do the Simple Start then stick to the Bookkeeping Template until you are ready to make the transition.

- Another option is QuickBooks Desktop. This is a higher cost than QuickBooks Online, $249.99 for the Desktop Download, however, I personally prefer Desktop over Online. Plus, you can make the one time purchase and use the software for a few years before updating to the newest release.

The reason I recommend QuickBooks is because it’s the best bang for your buck. Especially if you’re only doing books for yourself personally and your businesses. If you’re trying to build a bookkeeping business and working for multiple clients, then we can discuss other software options! Send me a message, if that’s the case, I’d be happy to help you decide on what software to use!

ACCRUAL BASIS VS. CASH BASIS

Most start-ups and small businesses use the cash basis accounting method. Cash basis the simple to understand and easy to implement. However, there are IRS regulations on reporting with the cash basis method.

You can always report on an accrual basis, but on a cash basis, once you reach a certain level in your business you need to make the switch.

To make this short and sweet, the IRS has a gross receipts test and any corporation or partnership (that is not a tax shelter) can generally use the cash basis method IF its average annual gross receipts for the last three tax years were $25 million or less. If you’d like to read more in-depth about the IRS regulations on the cash basis tax reporting method, click here!

Let’s quickly do a refresher on the difference between the two-

CASH BASIS

Cash basis means you record the transaction when it happens. When “cash” exchanges hands.

So, for example, you receive a utility bill on August 15th, but it is not due until September 5th.

You record the transaction when the cash leaves your bank account which is September 5th in this case.

ACCRUAL BASIS

Accrual Basis means you record the transaction when it occurs.

So, in the same example, you receive a utility bill on August 15th, but it is not due until September 5th.

Even though the cash will not leave your bank account until September 5th. You record the transaction on the day you received the bill August 15th.

It is important to understand the difference between cash and accrual basis because if you are looking at an accrual financial statement, it is telling you something different than a cash basis statement.

You need to select the appropriate accounting method that clearly reflects your income and expenses. There is also inventory to consider in this decision. If you have inventory and need to report inventory on your tax return, then take a look at the IRS Publication 538 “Inventories” section.

ADJUSTING JOURNAL ENTRIES IN ADVANCED BOOKKEEPING

Most of the reporting that you do in beginner and intermediate bookkeeping is very basic income and expense reporting with a little balance sheet reporting. By very basic, I mean, that you see the transaction on your bank statement, and you report that on your books with no further consideration of actual values or balances.

Don’t get me wrong, that is a GREAT starting point because the bank account reporting gives you a lot of what you need. But there are just a few more tweaks to be made.

To show an accurate reflection of the balance sheet and income statement, there are some adjusting journal entries that need to be made.

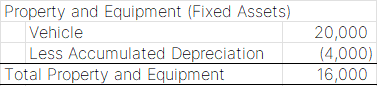

Let’s look at one that you’re familiar with. In intermediate accounting, we discussed the example of buying a vehicle and needing to correctly report the value of the vehicle by having accumulated depreciation. Here’s the section from intermediate accounting –

- For example, if you buy a $20,000 vehicle, as soon as you drive it off the lot it is no longer worth $20,000. Therefore, you have to correctly report the vehicle’s value on the balance sheet. If the vehicle’s expected life is 5 years, then you would have a depreciation expense of $4,000 each year until you reach $20,000 in accumulated depreciation. After the first year of owning the vehicle, this is how your balance sheet would look –

Okay, so how in the world do you get that accumulated depreciation number in your books since you never wrote a check for it?

Ding, ding, ding! You guessed it – Adjusting Journal Entries.

This is where beginner and intermediate bookkeeping may reflect inaccurate reports. If you never report anything other than what’s in your bank statement, then you will have highly inflated assets, and if any liabilities, those more than likely will be underreported.

So, the adjusting journal entry to correctly reflect the vehicle is as follows:

| ACCOUNT | DEBIT | CREDIT |

| Depreciation Expense | $4,000 | |

| Accumulated Depreciation | $4,000 |

Many adjusting journal entries involve an income statement account (revenue or expense) and a balance sheet account (asset or liability).

Here’s an example of other adjusting journal entries you may need: allowance for doubtful accounts, change in market value, accrued expenses, accrued income, prepaid expenses, deferred revenue, and unearned revenue.

Grab the Adjusting Journal Entry template, to make your life easier when it comes to making these adjustments!

CASH FLOW STATEMENT

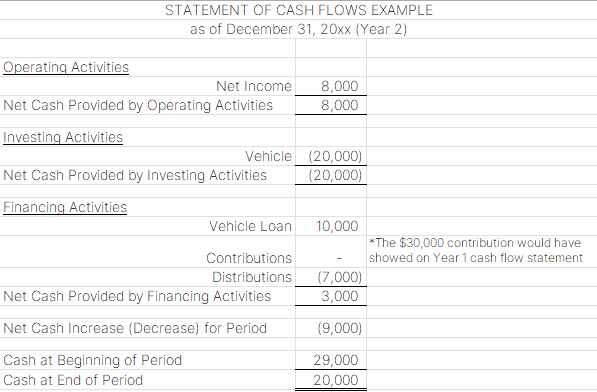

This statement is the third statement you need to tell the entire financial story of a company. (Remember income statement and balance sheet are the other two)

The cash flow statement provides details of what happened to the company’s cash during a given period.

The cash flow statement is broken down into three categories: Operating Activities, Investing Activities, and Financing Activities.

OPERATING ACTIVITIES

Operating activities are basically the income statement. It includes the revenue and expenses of the company.

INVESTING ACTIVITIES

Investing activities show the purchasing or selling of assets. So, it is basically the Property & Equipment (Fixed Assets) section of the balance sheet.

FINANCING ACTIVITIES

Financing activities show the debt and equity financing for the company. In other words, it is the Liabilities and Owner’s Equity section of the balance sheet.

After completing the cash flow statement, the “Cash at End of Period” balance should match your balance sheet Cash Account (Cash and Bank Account) total at the given period.

Here is an example of a Cash Flow Statement:

Now that you’ve seen all three statements in action separately, get a good refresher on how they all work together in this post.

But give your brain a break first!

Congratulations on moving up to an accurate set of books! Keep it up, and always work on improving yourself and your business to be better than yesterday!

All videos are made with Animaker, sign up for free today!