Now that you’ve advanced from Bookkeeping For Beginners, it’s time to move on to the balance sheet.

In the Bookkeeping For Beginners blog post, you learned how to put together a profit and loss statement.

The Bookkeeping Template gave you the ability to track income and expenses.

If you are moving up from Beginner to Intermediate, you should look into getting accounting software to move forward with your bookkeeping practices.

BOOKKEEPING SOFTWARE

Bookkeeping software will help you generate reports easier than excel. Especially when adding the balance sheet into your set of financial statements. Here are a couple of options I recommend –

- QuickBooks Online is a great option if you work from multiple devices, and for you to easily share your books with your accountant. If you choose to use QuickBooks Online, do not start with QuickBooks Self-Employed ($7.50/mo), simply because you will quickly find out that you will need to transition to Simple Start ($12.50/mo or higher).

The transition process can be a pain. So, I highly recommend starting fresh with Simple Start which is $12.50/mo or $150 annually. I don’t get any commission for recommending QuickBooks Online, I just have had to help several clients switch from QB Self-Employed to QB Simple Start and they all wish they would’ve started with the QB Simple Start. So, save yourself the headache and spend the extra $5/mo.

If you aren’t convinced to do the Simple Start then stick to the free Bookkeeping Template until you are ready to make the transition.

- Another option is QuickBooks Desktop. This is a higher cost than QuickBooks Online, $249.99 for the Desktop Download, however, I personally prefer Desktop over Online. Plus, you can make the one time purchase and use the software for a few years before updating to the newest release.

BALANCE SHEET

First, let’s go over what the balance sheet even is.

We already know that the profit and loss statement shows what your business actually made for profit in a given period.

The balance sheet shows the “book value” of a company. Or if you’re keeping a set of books on yourself personally then the balance sheet shows your net worth!

Having a set of books for yourself personally is very beneficial for making decisions, organizing your finances, and overall being intentional with your money.

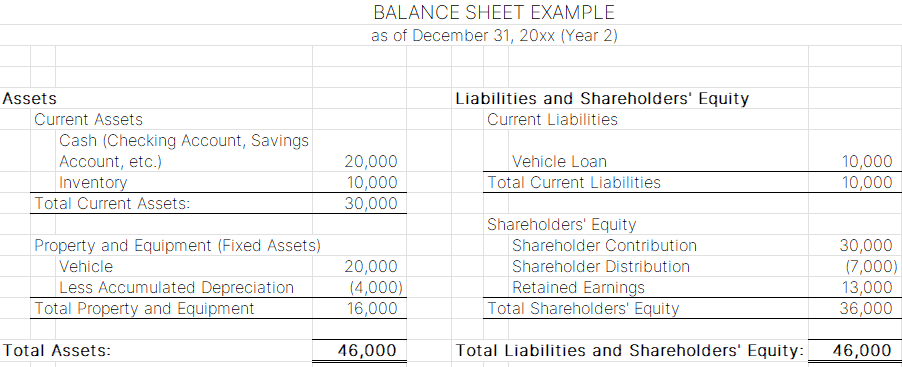

This financial statement shows the assets, liabilities, and owner’s equity.

Here’s where we’re going to spark your memory from your high school accounting class.

Assets have to equal Liabilities plus Owner’s Equity. Why?

Because it’s a balance sheet, and that’s how it balances!

If you read the blog post on How To Read Financial Statements, then the following information may look familiar to you, because we are going to break down the balance sheet in a similar way.

ASSETS

Assets are anything valuable that a company owns or anything valuable that you own personally.

Assets on a balance sheet are usually broken up into categories like Current Assets, Fixed Assets, Property & Equipment, Other Assets.

- Current Assets are usually cash, bank accounts, inventory, etc. Anything that is a short-term investment or can be converted into cash within one year.

- Fixed Assets, Property & Equipment are long-term investments held on for longer than a year and cannot be easily converted into cash. For example: land, buildings, equipment, etc.

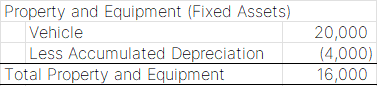

- In this category there is Accumulated Depreciation that is subtracted from the asset(s)’ original value.

- For example, if you buy a $20,000 vehicle, as soon as you drive it off the lot it is no longer worth $20,000. Therefore, you have to correctly report the vehicle’s value on the balance sheet. If the vehicle’s expected life is 5 years, then you would have depreciation expense of $4,000 each year until you reach $20,000 in accumulated depreciation. After the first year of owning the vehicle, this is how your balance sheet would look –

- Other Assets would include assets that do not logically fit into any of the main asset categories.

LIABILITIES

Liabilities is just a fancy word for debt. This shows everything that the company owes or that you owe personally. This even includes credit cards!!

Let’s use the vehicle example again. When you purchased that $20,000 vehicle. You paid $10,000 in cash and financed the other $10,000.

So, in the liabilities section, you would have a current liability of $10,000.

Liabilities are usually separated into current liabilities and noncurrent or long-term liabilities.

Current liabilities are liabilities that can be settled within one fiscal year. I.e., your vehicle loan, and credit cards.

Noncurrent or long-term liabilities are debts that are due after a year or more. I.e., your building loan or home loan.

OWNERS’ EQUITY

Equity is the ownership of assets and liabilities. This category contains Retained Earnings, Contributions, Distributions, and Common or Preferred Stock (only corporations).

We’re going to keep it simple so the only equity focus will be Retained Earnings, Contributions, and Distributions.

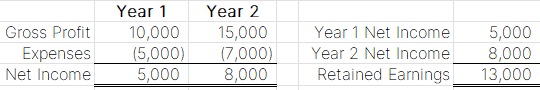

Retained Earnings are the accumulated net income of the company that is retained.

Did that sound like a foreign language?

Let me break it down with this example:

Since we are disregarding common and preferred stock, the total Retained Earnings after Year 2 is $13,000 ($5,000 year 1 net income plus $8,000 year 2 net income)

Contributions are owner contributions to the company. If the owner transferred in $30,000 of their personal money to get the business started in Year 1, then the Contributions on the balance sheet would show as $30,000.

Distributions are owner distributions from the company. If the owner took out $7,000 of company money in Year 2 for personal use then on the balance sheet the distributions would show as $7,000.

With all the examples given above, here is how the Year 2 balance sheet would look.

Understanding how to read a balance sheet and income statement together will tell you MOST of the financial story of a company. We still have one more financial statement that will tell you the rest of the story. That is the cash flow statement.

If you want a head start on learning about the cash flow statement, then click here.

Otherwise, we will learn about it in Advanced Bookkeeping!

Best of luck on your bookkeeping journey! I’m excited for you to start keeping a legit set of books on your business or yourself!

All videos are made with Animaker, sign up for free today!